My name is Daniel Smith and this is part of the continuing forfeiture fighter series of videos that's being sponsored by San Diego defenders today we'll be talking about just generally about why all these forfeitures are happening why is the government taking so much money and by the government I mean the United States government currently, the United States government is taking 2.7 billion dollars per year in forfeitures in assets and properties of people of foreign nations and of the United States citizens as well. Now what's causing all of that? Part of the reason is that there is a $15,000 excuse me $15,000 pesos per month deposit tax that is levied upon Mexican citizens or citizens that have peso accounts in Mexico so what does that mean if you deposit $15,000 pesos per month you are taxed 3%. Fifteen thousand pesos is about 1400 dollars at the rate of 13 pesos per dollar as an exchange rate so what is this causing to happen? Well, many people are storing their money or stuffing it in their mattresses in order to avoid the 3% tax. Nobody likes taxes, nobody likes taxes that are hard to explain, so should you be penalized for depositing pesos or currency in a bank? That's part of the problem. So you get these good citizens of Mexico that are stashing their money and will invariably come across the United States border. I have a diagram screws that may be yours United States border driving across the border with their car, and they might be coming across and is simply coming across the border talking to an agent an u.s. customs agent, and they might declare, “I have $9,000 in US currency that I'm bringing across the border.” Well, unfortunately, the what's happening is...

PDF editing your way

Complete or edit your 258 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export cbp financial online directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your cbp disclosure as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your customs form 258 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Cbp Form 258

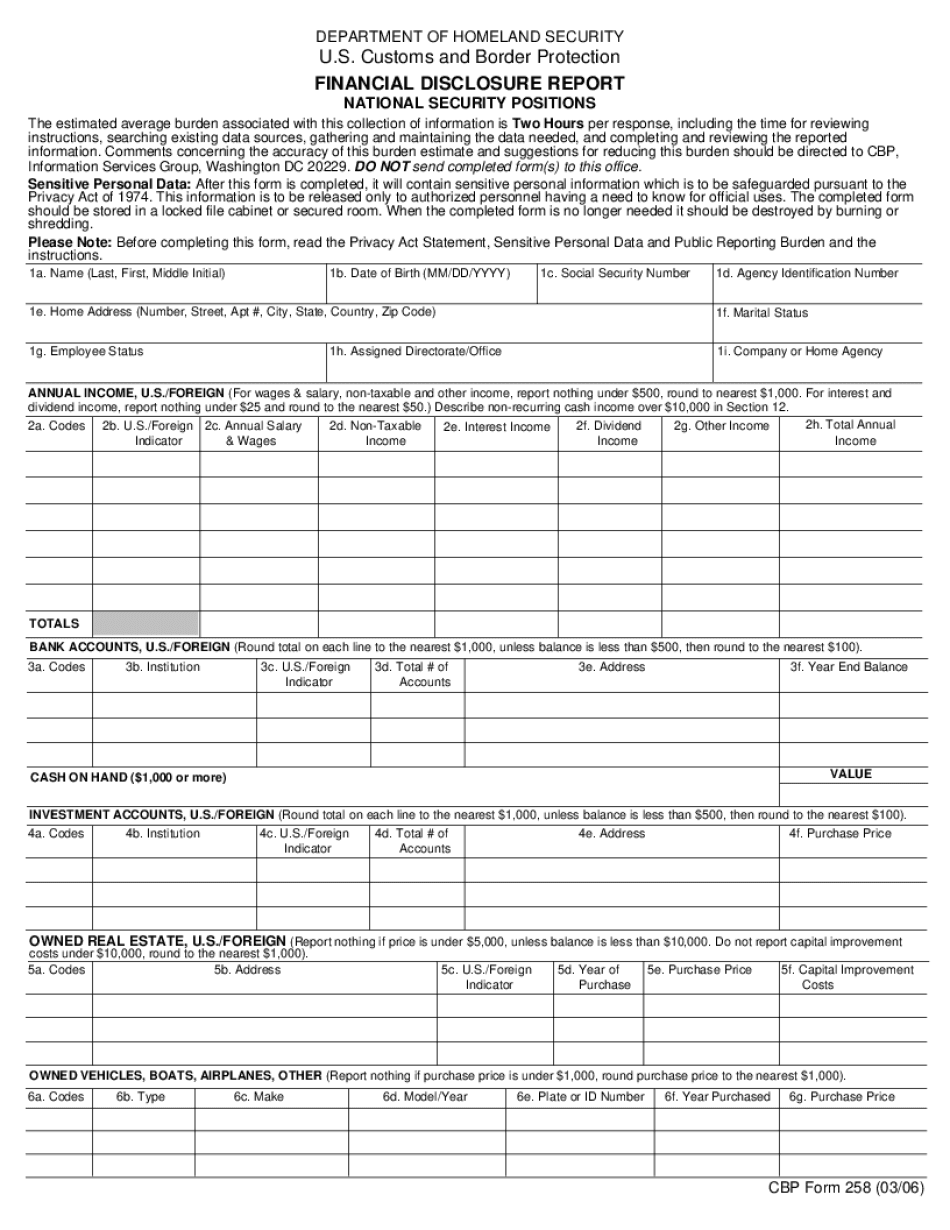

About Cbp Form 258

CBP Form 258 is a Document Verification Request form used by U.S. Customs and Border Protection (CBP) to verify and authenticate documentation provided by individuals seeking admission into the United States. This form is usually used by a referring entity, such as a government agency or employer, to request that CBP verify that the presented documents, such as passports, visas, and other identification documents, are valid and authentic. The form can also be used to verify documents for employment or licensing purposes. Anyone who needs to verify the authenticity of a document for official purposes may use CBP Form 258.

Online technologies make it easier to organize your file management and improve the productivity of your workflow. Look through the quick guideline so that you can fill out Cbp Form 258, avoid mistakes and furnish it in a timely way:

How to fill out a Fillable 258 Form?

-

On the website hosting the document, click on Start Now and pass to the editor.

-

Use the clues to complete the relevant fields.

-

Include your individual data and contact information.

-

Make certain that you choose to enter right details and numbers in suitable fields.

-

Carefully check out the written content of the form as well as grammar and spelling.

-

Refer to Help section in case you have any issues or contact our Support team.

-

Put an digital signature on your Cbp Form 258 printable while using the support of Sign Tool.

-

Once the form is completed, press Done.

-

Distribute the ready form by way of electronic mail or fax, print it out or download on your device.

PDF editor lets you to make improvements to your Cbp Form 258 Fill Online from any internet linked device, customize it according to your requirements, sign it electronically and distribute in several means.

What people say about us

Complicated paperwork, simplified

Video instructions and help with filling out and completing Cbp Form 258